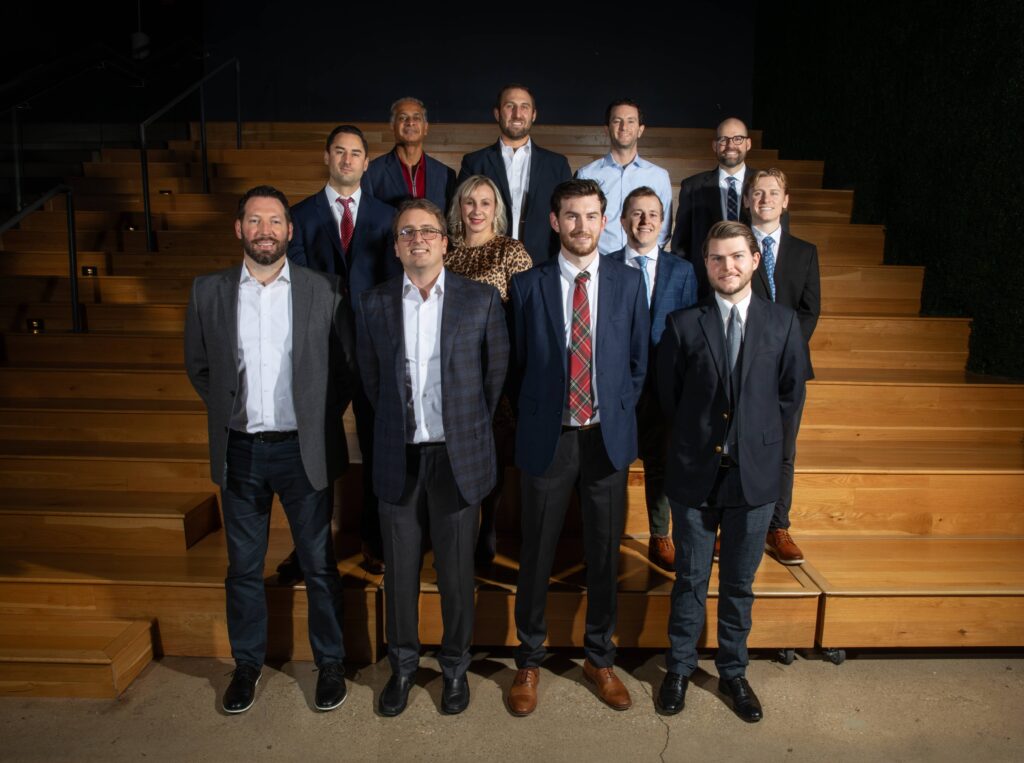

Thank you to everyone who joined Novo Advisors for dinner and a show at nationally acclaimed The Second City in Chicago. It was an especially special night as the partners at Novo introduced our expanded team. The show was, as always, beyond impressive, and allowed us a chance to relax and laugh a lot! It's a great way for our team to meet our clients’ spouses and significant others and connect on a deeper and more personal level. Who is going to forget all of the folks from our group that were brought up on stage and asked to perform that night? We told you our consultants have many talents! At Novo, we always put the focus on building relationships, and thank you for the support!

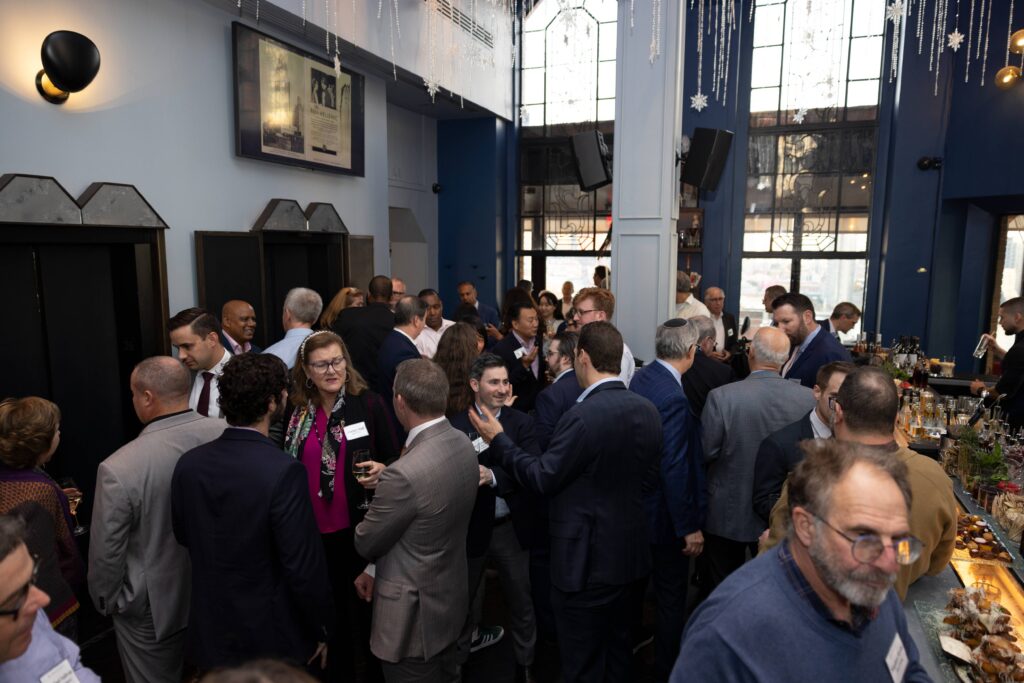

A huge thank you to the over 100 bankruptcy and turnaround professionals who joined us last month to celebrate our official NYC launch party at Ophelia Lounge in the historic Beekman Tower. The weather was perfect for the 360-degree terrace on the 26th floor showcasing NYC’s stunning Manhattan views. The food was flowing as were the cocktails, including Ophelia’s signature — the Purple Tuxedo. Novo Advisors’ current NY team includes Sandeep Gupta, Matt Cohn, Rob Vanderbeek, Kevin Neuman, and Claudia Springer. We hope to see you all at the next one!

Click a photo below to view the slideshow.

Chicago (October 12, 2023) — Novo Advisors, a premier turnaround consultancy serving middle market firms nationwide, is proud to announce new offices in Nashville and Minneapolis, adding capabilities to its team based in Chicago, New York and Philadelphia.

In Nashville, Dustin Bernstein joins Novo Advisors as a Managing Director. Dustin is a skilled financial consultant with more than 12 years of professional experience in industries including healthcare, manufacturing, hospitality, agriculture, metals and distribution. Prior to joining Novo, he held consulting positions at both global and boutique restructuring advisory firms, working with businesses from $20 million – $6 billion in sales. Earlier in his career, Dustin received his CPA designation in the state of Illinois. His expertise includes financial analysis, special situations, M&A, break-even analysis, business plan validation, liquidation analyses and cash flow forecasting.

We are pleased to welcome Dustin and Alex to the Novo family.”

Sandeep Gupta

Managing Partner, Novo Advisors

In Minneapolis, Alex Cariveau joins Novo Advisors as a Director. Alex brings more than 13 years’ experience working directly in functional financial roles — including Director of Finance — for manufacturing, entertainment and food and beverage businesses. His specialties include FP&A, cost accounting, working capital optimization, reporting and process improvement. Alex was also previously certified as a CPA in the state of Washington.

“We are pleased to welcome Dustin and Alex to the Novo family,” said Sandeep Gupta, founder and Managing Partner of Novo Advisors. “Both contribute special capabilities valued by our clients: Dustin for his background as a turnaround consultant, business advisor, investment banker and interim CFO; and Alex for his financial experience working across a wide arrange of industries.”

Novo Advisors is unique among many turnaround and restructuring consultancies in offering the expertise needed to serve in interim management roles, including CEO, CFO and COO. In addition to its varied industry experience, many members of Novo Advisors’ team apply direct, functional business knowledge and experience to initiate and speed turnaround and performance improvements for clients.

“The fact that we’re not career consultants, and that we can move from financial advisor directly to the C-suite when needed, benefits our clients,” notes Gupta. “Our grasp of the nuances of doing business is more comprehensive and grounded because of our functional experience — as is our ability to recommend and enact operational changes. And our ability to transition to interim management is efficient for clients since we are already steeped in the financial and operational details.”

Founded in 2012, Novo Advisors is a business transformation partner specializing in turnarounds and restructurings, performance improvement, transaction advisory, dispute resolution and interim management services for companies with $25 million – $1 billion in revenue. Novo offers clients rapid, customized solutions based on an immersive understanding of their business and financial issues, and the opportunity to work with a team of senior-level industry pros dedicated to delivering value every step of the way.

# # #

For more information, contact Anupy Singla at (312) 961-2565 or Anupy@novo-advisors.com.

New York (October 2023) — Novo Advisors, a premier turnaround consultancy serving middle market firms, is proud to announce the expansion of its office in New York. Representing clients nationally from its Chicago headquarters and offices in Philadelphia, Minneapolis and Nashville, the growth in New York further extends the company’s services into the Northeast region.

Joining Novo Advisors to lead the effort to develop its business there are two New York-based experts, Matt Cohn, Partner, with 25 years’ experience managing both in-court and out-of-court restructurings, managing liquidity and developing business plans; and Rob Vanderbeek, JD, Partner, with more than 30 years of restructuring, performance improvement and due diligence as well as litigation, valuation and forensic experience. Both have successfully managed restructurings, Chapter 11 bankruptcies, sales processes and a host of financial matters for clients in numerous industries.

Highly regarded for the services provided by its seasoned consultants, the addition of Matt and Rob to the Novo roster fits the company’s long-term growth strategy.

“Both Matt and Rob bring unique talents to Novo. Matt’s restructuring and CRO experience and his extensive background with municipalities brings strength to our existing team as well as new capabilities in public finance. Rob’s background as an attorney, his work as a COO, in performance improvement and forensic analysis for complex cases will be extremely valuable to clients,” said Sandeep Gupta, Novo Advisor Managing Partner. “Having these two new experts onboard significantly enhances our bench strength.”

New York and the Northeast region are vibrant business centers. We are excited to bring our talents as trusted, collaborative partners to companies based there with our expanded team.”

Sandeep Gupta

Managing Partner, Novo Advisors

Matt and Rob join the current Novo team in the Northeast: Kevin Neuman, Principal and also based in New York, is a 30-year healthcare industry expert and successful entrepreneur specializing in operational improvement, financial stability, technology and analytics. Claudia Springer, Principal and head of the Philadelphia office, is an award-winning restructuring and bankruptcy attorney and mediator recognized for her strong business acumen.

“New York and the Northeast region are vibrant business centers. We are excited to bring our talents as trusted, collaborative partners to companies based there with our expanded team” said Gupta.

Founded in 2012, Novo Advisors is a business transformation partner specializing in turnarounds and restructurings, performance improvement, operations, transaction advisory, dispute resolution and interim management services. The company offers clients rapid, customized solutions based on an immersive understanding of their business and financial issues, and the opportunity to work with a team of senior-level industry pros dedicated to delivering value every step of the way.

# # #

For more information, contact Anupy Singla at (312) 961-2565 or Anupy@novo-advisors.com.

Novo Advisors (Chicago) August 18, 2023: Thank you to everyone who made it to Offshore Rooftop to enjoy the Air & Water Show Experience with us. If you were not able to attend, we missed you and look forward to seeing you next year.

Click a photo below to view the slideshow.

What a great way to spend the day, enjoying the Air & Water Show with our wonderful clients. Thank you to everyone who attended this event, your involvement and support made it a truly exceptional gathering.

Click a photo below to view the slideshow.