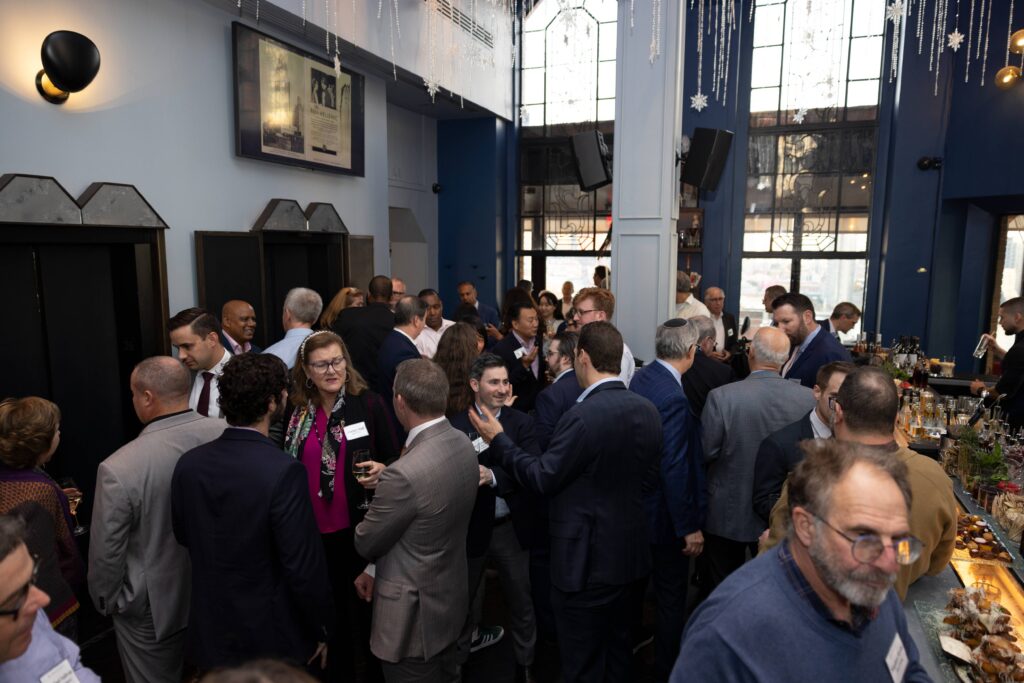

A huge thank you to the over 100 bankruptcy and turnaround professionals who joined us last month to celebrate our official NYC launch party at Ophelia Lounge in the historic Beekman Tower. The weather was perfect for the 360-degree terrace on the 26th floor showcasing NYC’s stunning Manhattan views. The food was flowing as were the cocktails, including Ophelia’s signature — the Purple Tuxedo. Novo Advisors’ current NY team includes Sandeep Gupta, Matt Cohn, Rob Vanderbeek, Kevin Neuman, and Claudia Springer. We hope to see you all at the next one!

Click a photo below to view the slideshow.

New York (October 2023) — Novo Advisors, a premier turnaround consultancy serving middle market firms, is proud to announce the expansion of its office in New York. Representing clients nationally from its Chicago headquarters and offices in Philadelphia, Minneapolis and Nashville, the growth in New York further extends the company’s services into the Northeast region.

Joining Novo Advisors to lead the effort to develop its business there are two New York-based experts, Matt Cohn, Partner, with 25 years’ experience managing both in-court and out-of-court restructurings, managing liquidity and developing business plans; and Rob Vanderbeek, JD, Partner, with more than 30 years of restructuring, performance improvement and due diligence as well as litigation, valuation and forensic experience. Both have successfully managed restructurings, Chapter 11 bankruptcies, sales processes and a host of financial matters for clients in numerous industries.

Highly regarded for the services provided by its seasoned consultants, the addition of Matt and Rob to the Novo roster fits the company’s long-term growth strategy.

“Both Matt and Rob bring unique talents to Novo. Matt’s restructuring and CRO experience and his extensive background with municipalities brings strength to our existing team as well as new capabilities in public finance. Rob’s background as an attorney, his work as a COO, in performance improvement and forensic analysis for complex cases will be extremely valuable to clients,” said Sandeep Gupta, Novo Advisor Managing Partner. “Having these two new experts onboard significantly enhances our bench strength.”

New York and the Northeast region are vibrant business centers. We are excited to bring our talents as trusted, collaborative partners to companies based there with our expanded team.”

Sandeep Gupta

Managing Partner, Novo Advisors

Matt and Rob join the current Novo team in the Northeast: Kevin Neuman, Principal and also based in New York, is a 30-year healthcare industry expert and successful entrepreneur specializing in operational improvement, financial stability, technology and analytics. Claudia Springer, Principal and head of the Philadelphia office, is an award-winning restructuring and bankruptcy attorney and mediator recognized for her strong business acumen.

“New York and the Northeast region are vibrant business centers. We are excited to bring our talents as trusted, collaborative partners to companies based there with our expanded team” said Gupta.

Founded in 2012, Novo Advisors is a business transformation partner specializing in turnarounds and restructurings, performance improvement, operations, transaction advisory, dispute resolution and interim management services. The company offers clients rapid, customized solutions based on an immersive understanding of their business and financial issues, and the opportunity to work with a team of senior-level industry pros dedicated to delivering value every step of the way.

# # #

For more information, contact Anupy Singla at (312) 961-2565 or Anupy@novo-advisors.com.

Novo Advisors (Chicago) August 18, 2023: Thank you to everyone who made it to Offshore Rooftop to enjoy the Air & Water Show Experience with us. If you were not able to attend, we missed you and look forward to seeing you next year.

Click a photo below to view the slideshow.

Novo Advisors (Philadelphia) May 4, 2023: Thank you to everyone who made it to Steak 48 on Thursday to help celebrate our growing Philadelphia presence. Claudia Springer (Principal – Philadelphia) is our contact in the area. Sandeep Gupta (Founder & Managing Partner – Chicago), Tom Caulfield, (Principal – Chicago), Nick Mungor (Partner – Chicago) were excited to meet everyone. If you were not able to attend, we missed you and look forward to seeing you at our next event.

Sandeep Gupta, Managing Partner, Rian Branning, Partner, Tom Caulfield, Principal, and Claudia Z. Springer, Principal will be representing our firm at the 2023 TMA Distressed Investing conference in Las Vegas from January 31 – February 3.

The 2023 TMA Distressed Investing Conference is the preferred meeting place for corporate restructuring and distressed investing professionals. Connect with capital providers and network with the industry’s leading professionals. Nearly 900 top dealmakers in the distressed investing industry will gather for live networking, professional development, and dealmaking.

Schedule time with one of our seasoned, senior-level industry pros to meet up and discover synergies. We look forward to connecting with many of the attendees during our time in Las Vegas.

Sandeep Gupta

Founder & Managing Partner

312-961-6854

SGupta@novo-advisors.com

Rian Branning

Partner

312-402-2982

RBranning@novo-advisors.com

Tom Caulfield

Principal

847-997-5017

TCaulfield@novo-advisors.com

Claudia Z. Springer

Principal

215-896-3775

CSpringer@novo-advisors.com

Claudia Springer — mediation practice head at Novo Advisors and retired Reed Smith partner who focused on restructuring and bankruptcy law — joined Reed Smith partner Keith Aurzada in this podcast to tackle the subject of mediation in difficult financial disputes. Claudia shares insight into how mediation helps parties understand the value of settlement and resolution, over allowing important disputes to linger.

What a great way to spend the day, enjoying the Air & Water Show with our wonderful clients. Thank you to everyone who attended this event, your involvement and support made it a truly exceptional gathering.

Click a photo below to view the slideshow.

Sandeep Gupta, Managing Partner, Tom Caulfield, Principal, Rian Branning, Partner, and Claudia Z. Springer, Principal will be representing our firm at these two conferences in Las Vegas, from February 8-11.

SFNet’s Asset-Based Capital Conference offers outstanding networking opportunities, exciting keynote speakers and insightful panels geared specifically for asset-based lenders in the capital markets, bringing together the decision makers who get deals done.

The TMA Distressed Investing Conference is the preferred meeting place for corporate restructuring and distressed investing professionals. Connect with capital providers and network with the industry’s leading professionals. Over 700 top dealmakers in the distressed investing industry will gather for live networking, professional development, and dealmaking.

Schedule time with one of our seasoned, senior-level industry pros to meet up and discover synergies. We look forward to connecting with many of the attendees during our time in Las Vegas.

Sandeep Gupta

Founder & Managing Partner

312-961-6854

SGupta@novo-advisors.com

Rian Branning

Partner

312-402-2982

RBranning@novo-advisors.com

Tom Caulfield

Principal

847-997-5017

TCaulfield@novo-advisors.com

Claudia Z. Springer

Principal

215-896-3775

CSpringer@novo-advisors.com

Philadelphia, May 18, 2021. Novo Advisors, a premier Chicago-based turnaround consulting firm, today announced that restructuring and bankruptcy attorney and mediator Claudia Z. Springer has joined the firm. In addition to starting Novo’s mediation practice, Ms. Springer will head up the firm’s expansion into Philadelphia, a new market for Novo, which currently has offices in Chicago, Denver, New York, and Atlanta.

“Claudia is a creative thinker, a great listener, is extremely thoughtful and comes up with creative solutions to resolve conflicts,” said Sandeep Gupta, Founder & Managing Partner of Novo. “In the financial world, time is money and someone who can resolve disputes quickly is a benefit to all parties and will be a strong asset to our firm and to our clients.”

Ms. Springer brings with her over four decades of experience in financial conflict resolution.

“Novo is a seasoned financial partner and a perfect complement to my skills,” said Springer. “Much of the challenge in the financial space is assessing both current and future value and trying to predict outcomes. The combination of my legal skills and the financial expertise of my new colleagues will add value in both mediations and working with financially challenged businesses.”

I am delighted to join the firm and look forward to helping clients with their challenges.”

Claudia Z. Springer

Novo Advisors is a business transformation partner — specializing in restructuring and performance improvement — offering middle-market clients big firm experience with boutique agility, and the opportunity to work with a team of seasoned, senior-level industry pros dedicated to delivering value every step of the way. Headquartered in Chicago and founded in 2012 by Gupta, Novo Advisors focuses on businesses generating between $25 million and $1 billion in revenue.

Prior to joining Novo, Ms. Springer was a partner at Reed Smith for almost twenty years, where she practiced restructuring and bankruptcy law. She has been acknowledged as one of America’s leading insolvency and corporate restructuring attorneys by Chambers USA: America’s Leading Business Lawyers every year since its initial publication in 2003. She was one of the youngest inductees in the American College of Bankruptcy, where she served on its Board for two terms and currently heads up a committee. In addition, Ms. Springer has been recognized as one of the nation’s top restructuring and bankruptcy lawyers by America’s Best Lawyers and America’s Best Business Lawyers and is a Pennsylvania Super Lawyer.

“After working with Novo Advisors on several assignments while I was at Reed Smith, I saw how our mutual clients benefitted from their hands-on approach and constructive recommendations,” Springer said. I am delighted to join the firm and look forward to helping clients with their challenges.”

###

For more information, contact Anupy Singla at (312) 961-2565 or info@novo-advisors.com.